Cash Receipts, Adjustments, and Customer Billing Report

The Cash Receipts, Adjustments, and Customer Billing (CRAB) report is used to reconcile customer balances due. You can choose to summarize billing by either supplier (default) or by sales channel. This report is static and contains information current only as of the selected date range. The default date range ends as of yesterday’s date. This report is broken out into three sections: Cash Receipts and Refunds, Adjustments, and Billing. You can view details for each line item of each section of the report.

Note: To work properly, these reports require a payment gateway to have been set up on the account. All merchant account information is entered by Inntopia staff as part of your payment gateway configuration. If you need to set up or change your payment gateway configuration, contact Inntopia Partner Services.

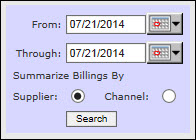

- In Inntopia CRS, click the Reports & AR/AP tab. The Reporting, Receivables and Payables page appears.

- In the Receivables section, click Cash Receipts, Adjustments, and Customer Billing. The date selector appears.

- Enter the dates for the information you want to include on the report. The default date is yesterday’s date.

- From – Enter the start date of the information to be included in the report.

- Through – Enter the end date of the information to be included in the report.

- Click the radio button corresponding to how you want to Summarize Billings (Invoices, Credits, and Total):

- Supplier (default) – Displays the billing information for each supplier that had a transaction occur during the selected date range.

- Channel – Displays the billing information for each sales channel that had a transaction occur during the selected date range.

- Click Search. The CRAB Report appears.

Samples of each report section are shown below.

Show Me Report Samples

Show Me Report Samples Cash Receipts and Refunds

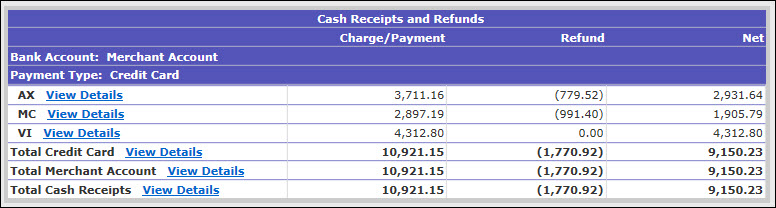

Cash Receipts and RefundsThe first section of the report, Cash Receipts and Refunds, appears when there are credit card and cash transactions to reconcile. Use this section of the report to reconcile those transactions.

If you have separate merchant accounts set up, the information for each merchant account is subtotaled and displayed separately in this section of the report.

The information in the Cash Receipts and Refunds section of this report is further broken out by payment type. In the credit card section, transactions for each credit card type appear on separate line items. You can also view detailed transaction information for each credit card listed on the report.

Show Me Column Descriptions

Show Me Column Descriptions- Charge/Payment – Amounts or funds collected from guests or purchasers

- Refund – Amounts refunded to guests or purchasers

- Net – Total charges/payments and refunds

Adjustments

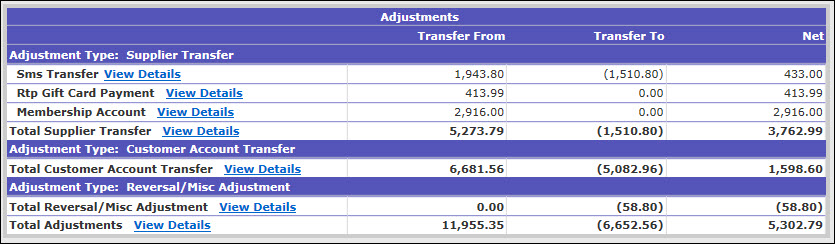

AdjustmentsThe Adjustments section of the report appears when there are special payment types, or non-cash payments, due. Special payment types include items such as account transfers, gift card payments, or membership accounts.

Any transactions using the adjustment/payment type Miscellaneous Adjustments/Reversal appear in the adjustments section of this report.

Show Me Column Descriptions

Show Me Column Descriptions- Adjustment Type – Lists the adjustments according to the type of adjustment that was made and the corresponding account used to make the adjustment if applicable.

- Transfer From – Amount of funds transferred from an account, typically used as payment method.

- Transfer To – Amount of funds transferred to an account, typically used as a refund.

- Net – Total amounts transferred to and from accounts.

Billing

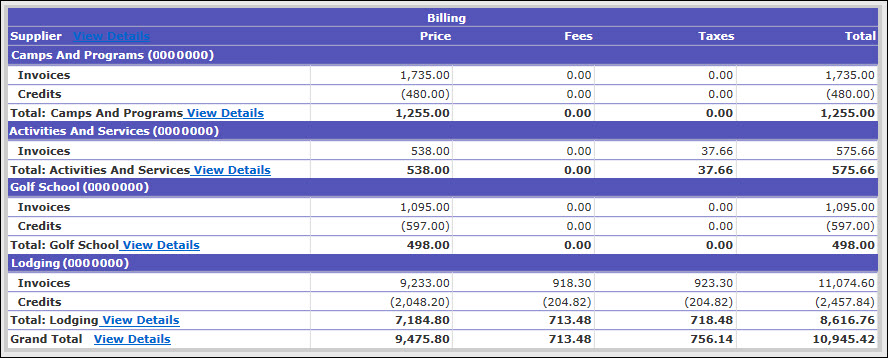

BillingUse the Billing section of the report to reconcile new charges to customers. In this snapshot of your sales, Invoice, Credit, and Total amounts appear for each supplier or sales channel.

If your CRS uses accrual accounting, the Grand Total of the Billing section equals the total sales of the selected date range.

Show Me Column Descriptions

Show Me Column DescriptionsSupplier – Entities who own the products sold by the reseller.

Price – Retail amount of the sales of products.

Fees – Retail fee amount on the sales of products.

Taxes – Retail tax amount on the sales of the products.

Total – Combined retail total of the price, fees, and taxes on the sales of the products.

- To see details of a particular subtotal, click its corresponding View Details link. A detailed transaction log for that subtotal appears.