Supplier Commission Statement

The Supplier Commission Statement lists every statement emailed as of the end of a given month. Once a list of supplier commission statements are selected, you can sort the statement results by Supplier Name, Account Number (Supplier ID), or Balance Due.

As a CRS agent, you can make the following adjustments to a Supplier Commission Statement:

- Add a charge

- Issue a credit

- Reverse charges such as tax or finance charges

- Reverse a credit or debit memo

- Manually adjust the Arrival and/or Departure date

- Manually adjust the Item

- Manually adjust the Sales Total for an Item

- Cancel a reservation

This report is currently available only to those resellers who are on a supplier collect business model and are using the Reseller Direct Billing feature of the Inntopia system.

- In your Inntopia CRS, click the Reports & AR/AP tab. The Reporting, Receivables and Payables page appears.

- From the list of reports, in the Receivables section, click Supplier Commission Statements. The statement selector appears.

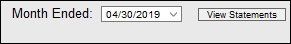

- From the Month Ended drop-down list, select the date that corresponds with the statement you want to view.

- Click View Statements. The selected Supplier Commission Statement appears. A sample Supplier Commission Statement list is below.

Show Me Column Descriptions

Show Me Column Descriptions- Supplier – Supplier name

- Supplier ID – Supplier number

- Balance Due – Total amount due from supplier for the selected month

- <Statement Date> Email – Links to a copy of the statement that was emailed at the beginning of the month

- Current – Links to a real-time, up-to-date statement. The real-time statement also includes a link to each itinerary's individual itinerary supplier commissions tab in which CRS users can make adjustments to commission billings.

This function provides an alternative way for any Direct Bill resellers to retrieve copies of Supplier Commission Statements other than looking for email copies. It also lets resellers email a particular statement to the supplier directly from the list. If the CRS agent decides they don't need email copies because they have this report, Inntopia staff can turn off their copies.

- Supplier Commission Statements can be sorted by Supplier Name, Account Number, or Balance Due. To organize the Supplier Commission Statement list, in the top-right corner, click the corresponding radio button. The statements are reorganized by the selected category.

- From the Supplier Commission Statement list, find the statement you want to adjust and click its corresponding Open link. The statement appears in a new window.

- In the top-right corner of the statement, click Enter Adjustment. A form appears at the top of the statement for you to make adjustments.

- From the Type drop-down list, depending on the type of adjustment you want to enter, select either Charge or Credit.

- If you want to enter a description of the adjustment, enter it in the Description field.

- If the adjustment amount is taxable, click the Taxable box.

- From the Billing Type drop-down list, select one of the following types of accounts to which the funds should be allocated:

- Commission Standard – Issue an invoice or credit memo for commission not previously billed

- Bad Debt –Issue a credit memo to write off a bad debt

- Finance Charge – Issue a finance charge

- Overpayment – Issue a credit memo to refund an overpayment

- Miscellaneous – Issue an invoice or credit memo that does not correspond with any of the above categories

- In the Amount field, enter the amount of the adjustment.

- Click Submit. A message appears confirming that the adjustment has been made.

- Click OK. The adjustment appears on the statement.

To reverse a charge, credit, tax, or finance charge on a Supplier Commission Statement, click that item's corresponding Reverse button. If an item does not have a Reverse button, it cannot be reversed.