Adjust Supplier Payables in Inntopia CRS

You can adjust Supplier payables in Inntopia CRS from the Supplier Accounts Payable screen. Depending on whether you want to adjust payment due to the Supplier or apply a charge back from a Supplier, you can create an invoice or a credit memo.

All adjustments made are recorded in the reseller's currency. For example, if your CRS is set to US Dollars (USD), but you are making an adjustment for a Canadian supplier, this adjustment is recorded as USD and shows in the Supplier and Travel Agent Payables queue in USD.

- From the CRS home page, click New Session and log a marketing source. To open the session in a new window, check the Open in new window box. Otherwise, leave this box unchecked.

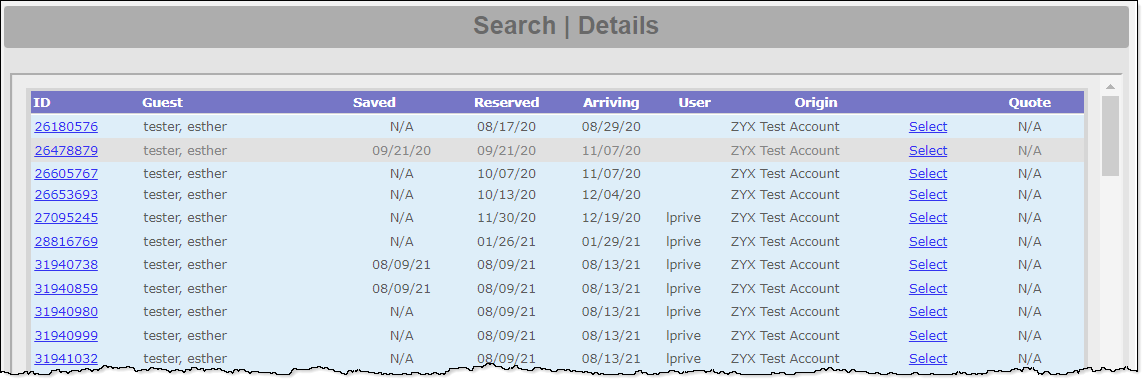

- In the Itinerary window, in the search fields, enter the itinerary ID number or name of the guest for whom the itinerary was created. Click Search.

A list of applicable itineraries appears in the Search | Details window. - Find the itinerary you want to work with and click its corresponding itinerary ID number. The Itinerary History window opens.

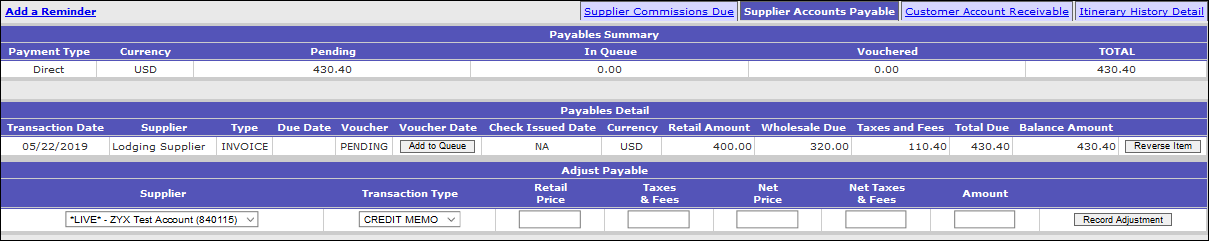

- At the top of the Itinerary History window, click the Supplier Accounts Payable tab. The Supplier Accounts Payable screen appears.

The following information is shown on the Supplier Accounts Payable screen:

Payables Summary

Payables Summary- Pending – A payable that has not been released to the Supplier and Travel Agent Accounts Payable queue/ has not reached the due date yet. The timing of when the payables release to the queue is determined by your settlement rule setting from the Supplier tab in the CRS.

- In queue – Generated payable that has reached its due date. These transactions can be viewed in the Supplier and Travel Agent Accounts Payable queue.

- Vouchered – Voucher has been generated to send payment to Suppliers.

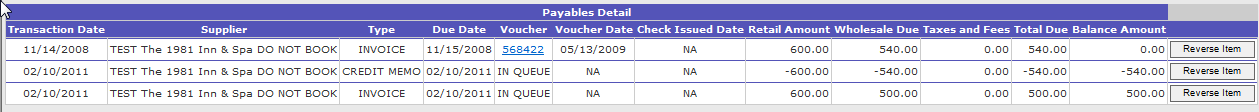

Payables Detail

Payables Detail- Transaction Date – Date the item will be due. This date is dependent on the accounting rule payables release timing.

- Supplier(s) – Name of supplier to whom the payable is owed.

- Type – Transaction type

- Due Date – Due date of payables. This date is determined based on accounting rules and can appear as blank until it's actual due date is reached.

- Voucher – A numeric link to the voucher.

- Voucher Date – Date that the voucher was created in Supplier and Travel Agent Payables

- Check Issued Date – Only used for Inntopia Processing Service

- Currency – Type of currency used for transaction (USD, CAD, etc.)

- Retail Amount – Price that was charged to the consumer

- Wholesale Due – Payable amount due to/from the Supplier

- Taxes and Fees – Total taxes and fees for itinerary

- Total Due – Total amount due to/from Supplier

- Balance – What is still owed to the Supplier

- Reverse Item button – Allows you to reverse a payable that is pending, in queue, or has been vouchered.

You can manually adjust a payable amount that is due to a supplier or one that has already been paid.

- From the CRS home page, click New Session and log a marketing source. To open the session in a new window, check the Open in new window box. Otherwise, leave this box unchecked.

- In the Itinerary window, in the search fields, enter the itinerary ID number or name of the guest for whom the itinerary was created and click Search.

A list of applicable itineraries appears in the Search | Details window. - Find the itinerary you want to work with and click its corresponding itinerary ID number. The Itinerary History window opens.

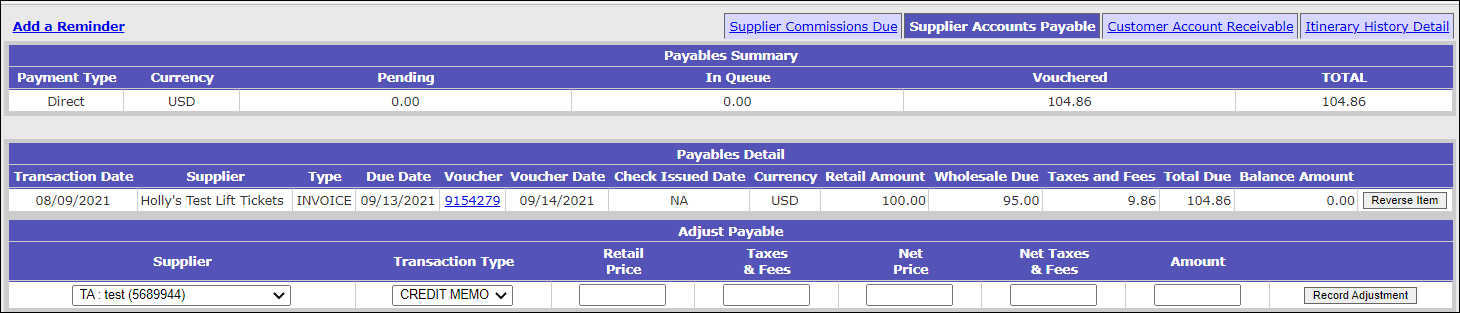

- At the top of the Itinerary History window, click the Supplier Accounts Payable tab.

- Scroll to the Adjust Payable section and from the Supplier drop-down list, choose the supplier to which you want to apply an adjustment to a payable.

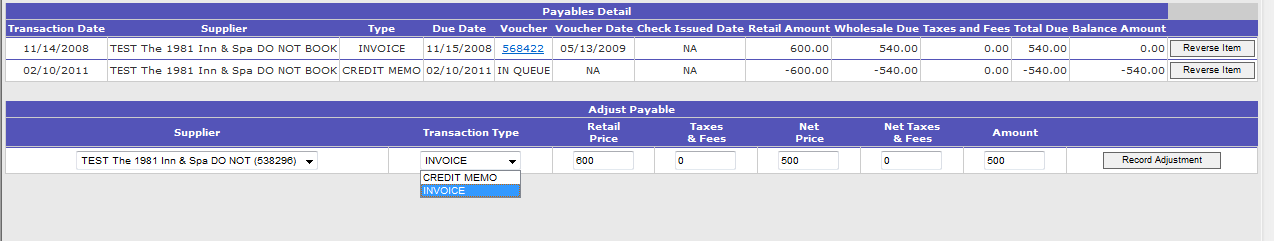

- From the Transaction Type drop-down list, select one of the following:

- Invoice – Use to adjust payment that is due to the Supplier.

Example: If a supplier payable is $75, but the pending payable is only for $60 you can adjust the pending payable in 1 of 2 ways:

- Credit Memo– Use to apply a charge back from the Supplier in cases where you may have over paid them previously, or already paid them and need get the money back from the Supplier.

Example: If a supplier payable was generated as $100, but the correct payable was supposed to be only be $60, you can adjust the pending payable by one of two ways:- Create a credit memo for $40 to reduce the amount of the payable OR

- Reverse the pending payable for $60.00 (this will then create a credit memo which closes the incorrect invoice), and create an invoice for $60.

- Invoice – Use to adjust payment that is due to the Supplier.

- In the Retail Price field, enter the full amount including mark up (amount charged/paid by consumer)

- In the Taxes & Fees field, enter the amount of taxes and fees due on the retail amount

- In the Net Price field, enter the negotiated rate to be paid to supplier

- In the Net Taxes & Fees field, enter the amount of taxes and/or fees on the net price

- In the Amount field, enter the total amount to be paid or collected from the supplier

Note: The system does not automatically calculate the Amount Due based on amounts entered in other fields. You must manually enter an amount in the total. If the Amount field is left blank, the total due remains at a $0.00 balance.

- When you have finished entering adjustment amounts, click Record Adjustment. The adjustment appears in the Payables Detail section.