Supplier Payables Tax Exclusion (British Columbia, CA)

In July 2023, the provincial government of British Columbia, CA updated a tax law that now requires resellers to remit GST on their commission, and all PST and Municipal tax. Inntopia suppliers and resellers affected by this tax rule can have a feature enabled in their Inntopia system to exclude those taxes from their supplier payables.

- This feature must be enabled by Inntopia staff per affected supplier.

- Tax can be excluded from product-specific, product category, and company-level taxes.

- The order of precedence for the tax exclusion is as follows:

- Product

- Product Category

- Company

- Both resellers and suppliers must configure their systems to correctly exclude the tax.

- A new tax set up to exclude tax automatically supersedes the existing tax upon the active date of the new tax.

To activate the ability to exclude tax payments from supplier payables:

- Submit a request to Partner Services to turn on the feature with the following information:

- Sales channel IDs of each sales channel for which you want to activate the feature

- Each associated supplier ID for which you want to activate the feature

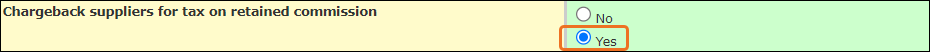

- On the Inntopia CRS Systems page of each sales channel for which the feature is activated, set the Chargeback suppliers for tax on retained commission setting to Yes.

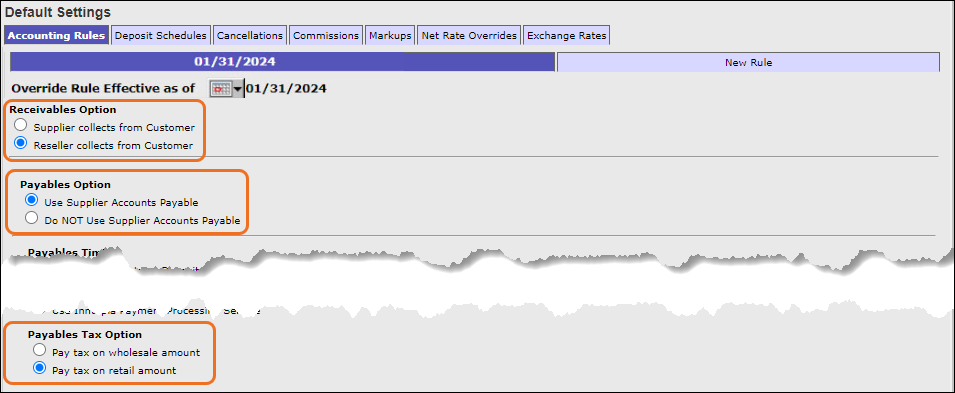

- On the Inntopia CRS Suppliers page of each sales channel and/or supplier for which the feature is activated, open the Accounting Rules tab and confirm or update the following rule settings:

- Receivables Option – Select Reseller collects from Customer

- Payables Option – Select Use Supplier Accounts Payable

- Payables Tax Option – Select Pay tax on retail amount

Note: If the existing accounting rules for the sales channel and/or suppliers need updaing to accommodate the tax rule, you must create a new accounting rule.

- Contact and instruct individual suppliers to complete the appropriate tax set up in their Inntopia RMS account for all affected Company, Product Category, and Product-specific taxes.

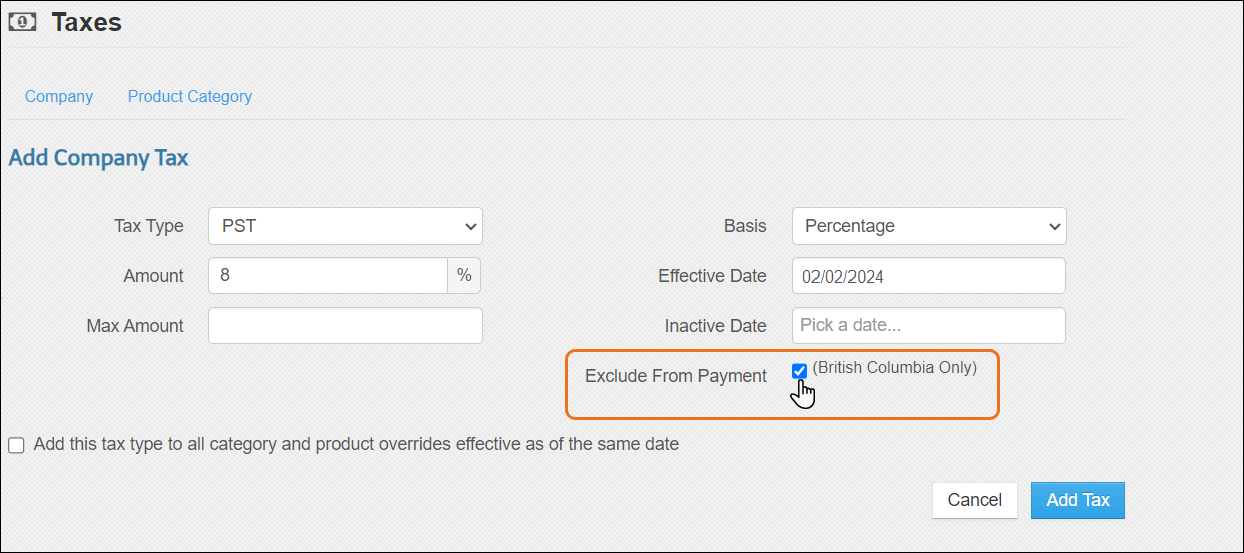

To exclude the tax payment from affected Company, Product Category, and Product-specific taxes:

- Log into your Inntopia RMS account and enter the information as you would when adding any tax:

- Click the Exclude from Payment checkbox and, depending on the type of tax, click Save Table or Add Tax.

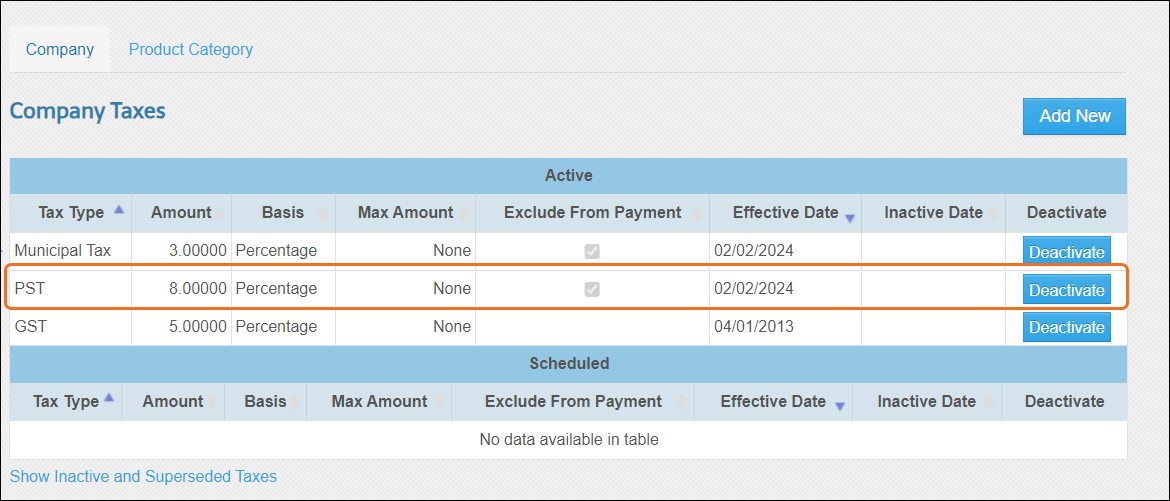

The tax appears in the list of taxes with a check mark in the Exclude from Payment column.

- Repeat this process for each tax that must be excluded from the supplier payables.