Wildcard Products

Wildcard products help you sell inventory that suppliers have not loaded into the Inntopia system and is not available for sale in a normal circumstance. Suppliers often do not provide their entire inventory to a reseller. Reservation agents using Inntopia CRS, however, can work in cooperation with the supplier to create a temporary product that a customer can reserve on a one-time basis. This type of product is called a “wildcard” because it can be any product type offered by any of your suppliers.

It is important to only create wildcard products in cooperation with the supplier. Because the product is not in the CRS inventory, agents must call the supplier to check availability and confirm pricing, taxes, and special instructions that may apply to the product before proceeding.

You must manually enter all information associated with a wildcard product into the system. To avoid confusion in the future, suppliers are advised to deactivate wildcard products once the sale has been finalized. The balance of the transaction works the same way that a regular, inventoried transaction works: the item is placed on an itinerary and payment is taken according to the deposit schedule.

Wildcards are strictly a one-time use product. They cannot be re-used and do not appear on searches made within the System; however, the name of the wildcard product does remain available in the system but is only visible to the supplier.

Wildcard products cannot be modified. To make changes to a wildcard product, you must first cancel the original wildcard product and create a new one.

- If you are certain a product will be used again in the future, have the supplier add the product in Inntopia rather than creating it as a wildcard product.

- Agents should not create a wildcard product if that product currently has zero availability but is otherwise typically inventoried. In such cases, the booking need can be accommodated by displaying, overriding, and booking the zero-availability product in a general search.

- If you are using the wildcard feature for a non-lodging product, the Proof of Purchase Voucher option is not available.

- Do NOT create products with $0.00 pricing that also include associated taxes and fees. Doing so causes problems with reconciling payables when such an item is cancelled or modified later.

- Product Inventory: Since the product is created "on the fly," the product has no inventory, rate detail, or description. The supplier should be advised by the CRS Agent when wildcard products are created and the products should then be deactivated in the supplier account. Otherwise, the wildcard could stay in the account for future uses (which Inntopia does not recommend).

- Product Inventory: Neither tax nor fee entries should be made in Inntopia RMS for wildcard products.

- Tax: If the wildcard supplier has entered a supplier-level tax schedule, the Inntopia system calculates the taxes and uses those in lieu of the tax amount entered. In these cases, the system also correctly calculates tax on net. If the supplier has not entered a supplier-level tax schedule, the system uses whatever amount was entered for both the retail and net tax.

During a peak holiday weekend, Hotel ABC has sold out all the regular hotel rooms. The only remaining room is the corner room overlooking a garbage dump. This room was not loaded as a product in the supplier account; therefore, it is not searchable in the CRS. The agent spoke with the supplier and the two parties agreed on a special price. The agent then created a wildcard product "on the fly." The agent advised the supplier to deactivate the wildcard product once the reservation was confirmed.

ZYX Condo Unit 101 is temporarily unavailable due to remodeling. The agent could not locate the unit in a search and created a wildcard without first consulting the supplier.

- From the CRS home page, click New Session and log a marketing source. To open the session in a new window, check the Open in new window box. Otherwise, leave this box unchecked.

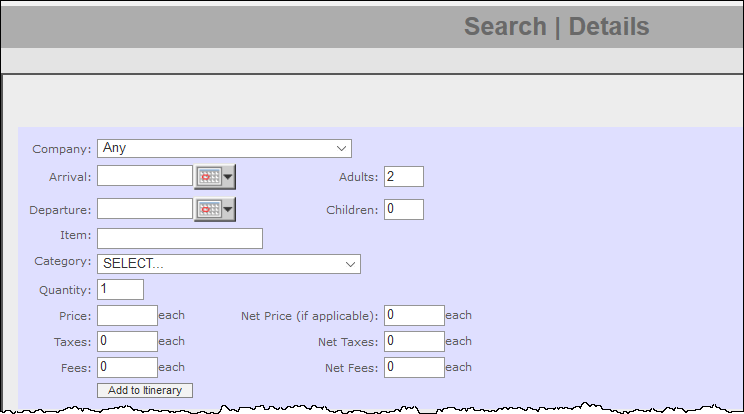

- From the top navigation menu, select Search. At the bottom of the drop-down list that appears, select Wildcard product. The Wildcard screen appears.

Show Me Field Descriptions

Show Me Field Descriptions* Denotes a required field.

- Company* – A supplier of products to Inntopia CRS.

- Arrival* – Date the customer plans to arrive or begin using the wildcard product.

- Departure* – Date the customer plans to depart or finish using the wildcard product.

- Adults – Number of adults to include in the wildcard product on the itinerary. The default number is two adults.

- Children – Number of children to include in the wildcard product on the itinerary. The default number is zero children.

- Item* – A drop-down list of previously created wildcard products for a company. You can re-use the name of a product, but must re-enter all the associated information.

- Item (blank item entry field) – Enter the name of a new item if it does not appear on the Item drop-down list.

- Category* – A product such as Lodging, Adventure Tour, Rental Car, or Ski School. This list includes all the product types/categories available in the Inntopia system.

- Quantity – The number of wildcard products of this type you want to create for the itinerary. The default number is one.

- Price* (each) – The total price (before taxes) of each wildcard product being created during a particular session.

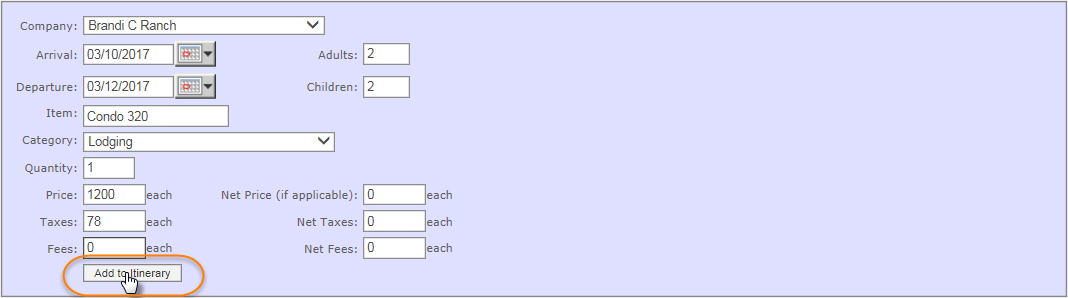

For example, for a three-day reservation at $400 per day, you would enter a Price of $1,200.

- Net Price (if applicable – each) – Specify a net price. If you leave this field blank or enter zero, the System calculates the amount due to the supplier based on the commission settings currently in effect for the supplier.

- Taxes – The total amount of tax calculated on the price of the wildcard product. For example, if the $1,200 price above was subject to a 6.5% tax rate, you would enter a total of $78 in taxes.

Note: If the supplier has set up default supplier tax rate tables, they are used to calculate the tax and any entry made in this field is ignored.

- Net Taxes – The total amount of tax due to the supplier on the net price of the wildcard. If the supplier does not have a company-level tax table and no tax is entered here, then the payable to the supplier will have $0 in taxes.

Note: If supplier has set up default supplier tax rate tables, they are used to calculate the net tax and any entry made in this field is ignored.

- Fees (each) – A sum of all fee types (all fees are treated as a single type). Fees are potentially subject to tax (tax calculated on the price plus the fee).

- Net Fees – If you enter a net fee amount, it is used to calculate the amount due the supplier. If you leave this field blank or enter zero, the System:

- calculates the value based on the current "Applies to Fees" commission-on-fees setting for the wildcard supplier

or

- the entire amount of the fees (if fees are not commissionable) are added to the retail amount of the product in the supplier payable.

Net fees are subject to tax (tax calculated on the price plus the fee).

- calculates the value based on the current "Applies to Fees" commission-on-fees setting for the wildcard supplier

- From the Company drop-down list, select the supplier of the wildcard product.

Note: To ensure the correct pricing policies and accounting rules are applied to the wildcard product, it is important to choose the actual supplier of the product rather than the name of your CRS for this field.

- In the Arrival and Departure fields, enter the arrival and departure dates for the wildcard product (MM/DD/YYYY format).

- In the Adults and Children fields, enter the number of adults and children arriving for the wildcard reservation.

- In the Item field, enter the name of the of the wildcard product.

- From the Category drop-down list, select a wildcard product category.

- In the Quantity field, enter the quantity of wildcard products being created (if other than 1).

- In the Price field, enter the dollar amount of each wildcard product.

Note: Enter the dollar amount of the item without taxes and fees. For example, if the rate is $400 per night and the guest is staying three nights, you would enter $1200 here.

- If applicable, in the Net Price field, enter the net price of each wildcard product.

- In the Taxes field, enter the tax dollar amount for each wildcard product. Notes:

- Enter the dollar amount of the taxes only. For example, if the total rate is $1200 and is subject to a 6.5% tax rate, you would enter $78 here.

- If the supplier has set up default supplier tax rate tables, they are used to calculate the tax and any entry made in this field is ignored.

- If applicable, in the Net Taxes field, enter the net tax dollar amount for each wildcard product.

Note: If the supplier has set up default supplier tax rate tables, they are used to calculate the net tax and any entry made in this field is ignored.

- In the Fees field, enter any fees associated with each wildcard product.

- If applicable, in the Net Fees field, enter the net tax dollar amount for each wildcard product.

- Once all applicable fields have been completed, select Add to Itinerary. The wildcard product is added to the itinerary.