Set Net Rates in CRS

Net rates let a reseller receive rates with the commission pre-deducted from a supplier. When working with net rates, you and your suppliers must communicate to ensure the net rates work correctly in your Inntopia system. Suppliers must send you correct net rates and you must correctly mark up the net rates supplied to you. The default net rate must be set by Inntopia staff.

The steps for setting net rates include:

- Reseller adds supplier to Reseller Supplier List.

- Reseller notifies supplier that account is ready to set net rate.

- Supplier sets net rate using Rate Optimizer.

- Reseller enters default net rate markup for all suppliers on Reseller Supplier List.

- If necessary, reseller enters markup override amount for specific supplier.

- If necessary, reseller enters final sales price override at the rate level for an individual rate.

Note: For assistance in setting your default net rate, contact Partner Services.

- The amount of tax to be paid to the supplier is configured on the Accounting Rules tab of each Inntopia CRS sales channel. You can select to pay the entire tax collected from the guests to your suppliers (Pay tax on retail amount) or to pay the tax amount on only the net rate owed to the suppliers (Pay tax on wholesale amount). Choosing to pay the tax amount on only the net (wholesale) rate will require the reseller to remit the tax owed on their margin/commission earned.

- The amount of fees paid to the supplier is always based on the retail amount collected from the guest as well as any tax collected on the fee.

Before you can receive net rates from your suppliers, you must add your suppliers to your reseller’s supplier list for each sales channel (parent and child accounts). After you add your suppliers to your supplier list, suppliers can then use the Rate Optimizer to give you a discounted net rate.

- If you have not already done so, add each supplier for which you want to use net rates to your Reseller Supplier List. Be sure to add suppliers for each sales channel (parent and child accounts).

- Notify each supplier that their account is ready for them to set up net rates.

By default you can enter a net rate markup amount as a percentage amount. Or you can enter an actual fixed fee dollar amount, however, this method is rarely used. Be sure to apply the appropriate markup to all applicable sales channels (parent and child accounts).

- Log into your Inntopia CRS account and from your CRS home page, click the Suppliers tab. The Supplier Management window appears.

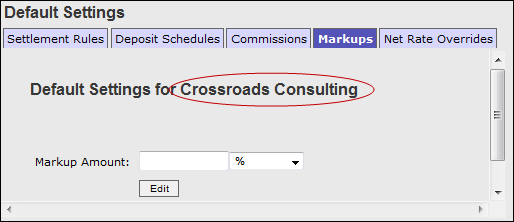

- In the Default Settings area, click the Markups tab. The Markups panel appears.

- In the Markup Amount field, enter the default markup amount you want applied to all suppliers in your Reseller Supplier List.

Show Me Calculated Markup Amounts

Show Me Calculated Markup Amounts To mark the discounted net rates back up to rack/retail rates, apply the appropriate mark up percentage in your CRS according to the chart below:

Supplier Net Rate Discount (%)

CRS Markup (%)

10% 11.11% 12% 13.64%

13%

14.94% 15%

17.65% 18%

21.95% 20%

25% 25%

33.33% 30%

42.86% 35%

53.85% 40%

66.67% 45%

81.82% - To change the markup amount calculation from the default of percentage to a fixed fee dollar amount, from the drop-down list, select Fixed Fee.

- Click Add. The amount you entered is saved in your Inntopia System and is applied to all suppliers in your Reseller Supplier List.

You can enter a markup override for a specific supplier. The override you enter here will only apply to the specific supplier you select.

- Log into your Inntopia CRS account and from your CRS home page, click the Suppliers tab. The Supplier Management window appears.

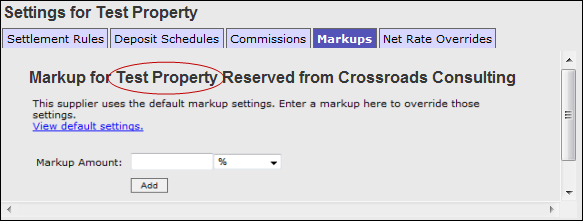

- In your list of suppliers click the Edit Settings link for the supplier to which you want to apply a markup override, and then click on the Markups tab. The Markups panel for the supplier you selected appears.

- In the Markup Amount field, enter the default markup amount you want applied to the specific supplier.

- To change the markup amount from percentage to a fixed fee dollar amount, open the drop-down list and select Fixed Fee.

- Click Add. The amount you entered is saved in your Inntopia System and will be applied only to the specific supplier you chose.

You can also use your Inntopia System to override the mark up for a particular rate. This feature lets you customize the final price for products associated with a particular rate.

For example, you can use the Net Rate Override to sell a product, such as lift tickets, at an exact round number. Lift ticket prices are often preset by ski areas months in advance. If a lift ticket supplier has set a net rate of $80 and the reseller has a net rate markup of 20% for that supplier, the sell price of the lift ticket is calculated at $96. However, the ski area preset the price of the lift ticket for $99. To reflect the ski area’s preset price of $99, you can change the $96 sell price to $99 using the net rate override feature.

- Log into your Inntopia CRS account and from your CRS home page, click the Suppliers tab. The Supplier Management window appears.

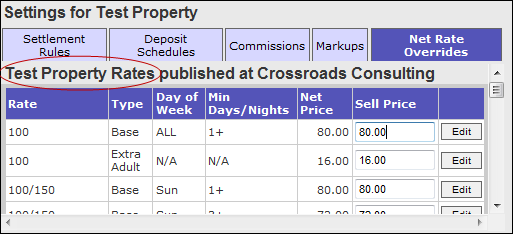

- In your list of suppliers, click the Edit Settings link for the supplier to which you want to apply a markup override, and then click on the Net Rates Overrides tab. The Net Rates Overrides panel for the supplier you selected appears displaying all rates for that supplier.

- Scroll through the list of rates and in the Sell Price field of the rate for which you want to override the markup, enter the price for which you want to sell products that have been assigned that rate and click Edit.

The Sell Price you entered is saved and is the price that customers will see for those products that have been assigned that rate.