Inntopia Commerce + Affirm®

Affirm is a monthly payment plan that offers your guests the flexibility to pay for their purchases in monthly installments. Having an easy payment schedule makes travel purchases feel more affordable which in turn encourages guests to maybe spend a little more than they might otherwise.

With the Affirm integration in place, when a guest chooses Affirm as their method of payment, they receive qualification confirmation and a payment plan from Affirm and you, as the reseller, receive 100% of the payment of the guest's purchase from Affirm.

Note: Affirm is only available to guests residing in the U.S. and U.S. territories.

- Affirm messaging can be customized on your site using the Inntopia branding tool. For more information, contact your Strategic Account Manager.

- Setting up an Affirm merchant account typically only takes two to three weeks.

- Minimum/maximum loan amount threshold can be established per merchant account. Affirm's own thresholds are a minimum of $50.00 and maximum of $17500.00.

- Affirm does not charge a fee to establish a merchant account.

- Affirm does not charge the customer any hidden, origination, or late-payment fees.

- Loans are processed in batch every 24 hours.

- Partners typically receive funds from Affirm within one to three days.

Affirm is supported in Inntopia's standard eComm booking engine and Inntopia CRS. It is also supported in custom front-end booking paths built by third parties who are certified with Affirm and utilize Inntopia's JSON API. To implement Affirm as a payment option:

- Your business must establish an Affirm merchant account and provide the Affirm API keys to Inntopia. For assistance, contact your Inntopia Account Manager or Inntopia Partner Services.

- Your Inntopia system must be set up to use the reseller collects business model.

- Each eComm sales channel for which you would like to allow Affirm transactions must be configured to accept Affirm.

- Each eComm sales channel for which you would like to allow Affirm transactions must be configured to accept the same type of currency as your Affirm account.

- All items, including insurance items, added to itineraries that are reserved using Affirm must be reseller-collect items.

Affirm does not charge any setup costs for establishing a merchant account.

Inntopia does not charge setup fees for a standard Affirm implementation. Additional development beyond the standard setup may incur a fee and is determined on a case-by-case basis.

- Only items sold from suppliers using the Reseller Collects business model are eligible for the Affirm payment option.

- The Affirm reservation processing flow:

- If an itinerary's items are able to be reserved against inventory currently available, a pre-authorized loan is captured.

- If the itinerary items cannot be reserved, the initial pre-authorization loan is voided, and the guest must go through the Affirm loan approval process again.

- If the reservation is successful, the actual loan is then captured (payment taken and recorded in the Customer Receivable record).

- If the loan cannot be captured due to a technical reason (e.g. network hiccup), the items remain reserved and the guest is notified that their payment must be reprocessed. An agent must log in to the Affirm Merchant Account to capture or void the loan.

- When an agent manually captures a loan, Inntopia does not receive an update from Affirm; therefore, a manual credit memo is required in Inntopia to balance the itinerary.

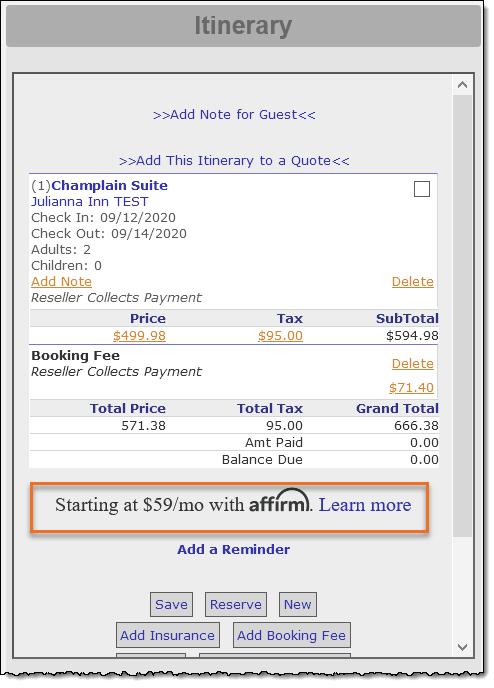

- Affirm banners and links for more information about the Affirm payment option appear in the search results, supplier details, and itinerary windows.

- Affirm payments appear on the Cash Receipts, Adjustments, and Customer Billing (CRAB) and Guest Payment Review reports.

- Affirm as a payment code is supported in Data Warehouse calls related to customer payments using payment type code 14.

For guests using the Affirm payment option through eComm, the checkout process is as follows:

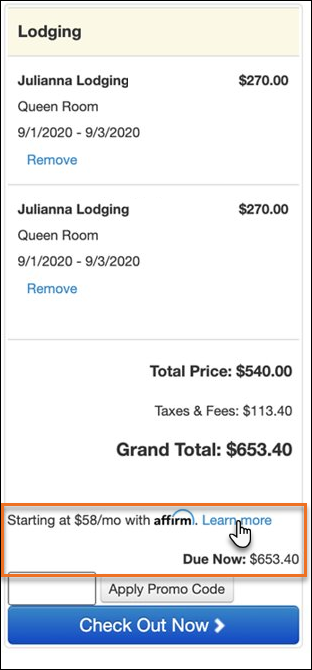

- Online guest builds itinerary and potential Affirm pricing appears in search results and on the itinerary.

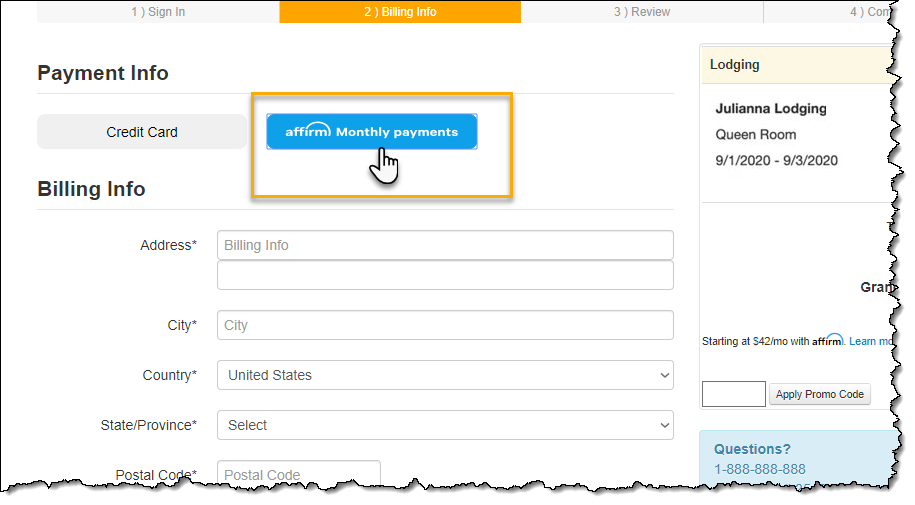

- Guest advances to the Billing Info screen and selects Affirm as the payment method.

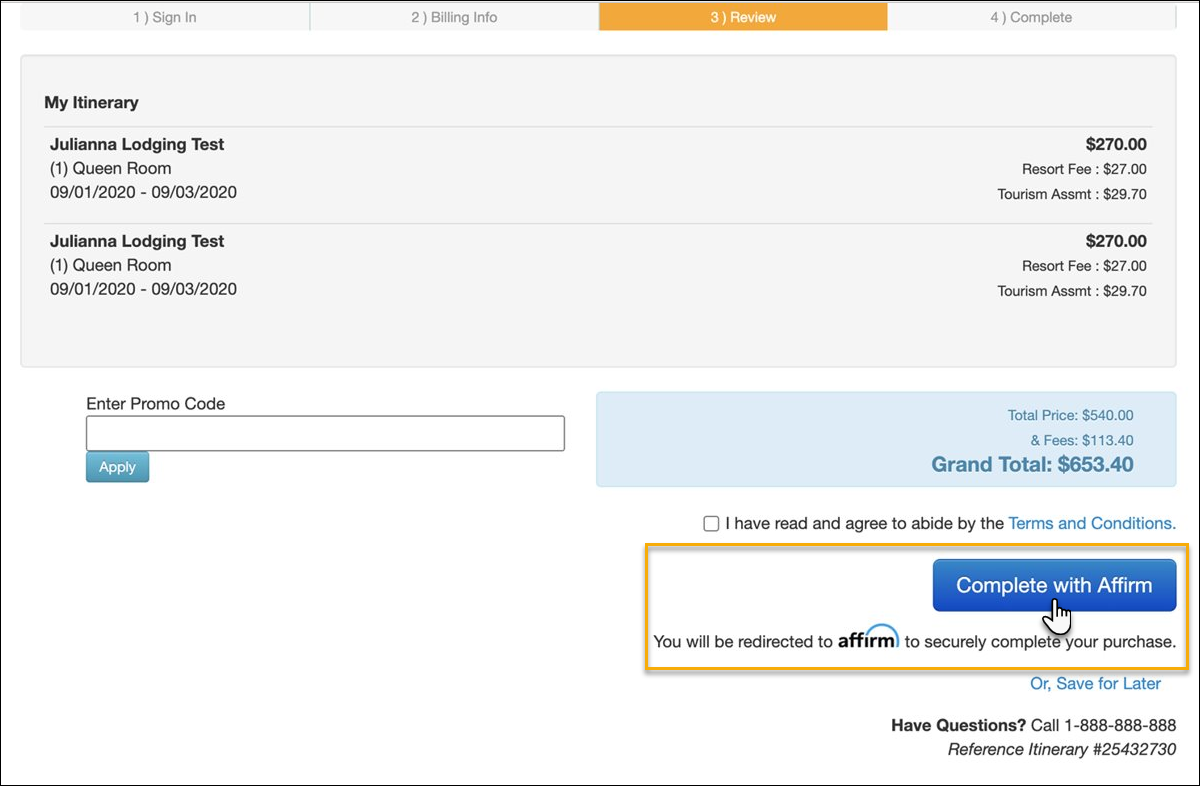

- Guest advances to the Review screen, clicks the Complete with Affirm button and is redirected to the Affirm website to begin the loan qualification process and select a payment plan.

- Once qualification is confirmed, Affirm settles the purchase with the partner, the reservation is completed, and guest is returned to the Inntopia confirmation page.

- Partner receives payment from Affirm within one to three days.

Guest can choose to learn about Affirm pricing by clicking the Affirm Learn More link from either search results or the itinerary window.

- Guests who select Save for Later while building their online itinerary must re-complete all billing steps upon completing the reservation.

- Billing information is not saved for new guests who check out with Affirm and have never entered credit card information in eComm before.

For guests using the Affirm payment option through Inntopia CRS, the checkout process is as follows:

- Agent builds itinerary and potential Affirm pricing appears on the itinerary for agent to relay to guest.

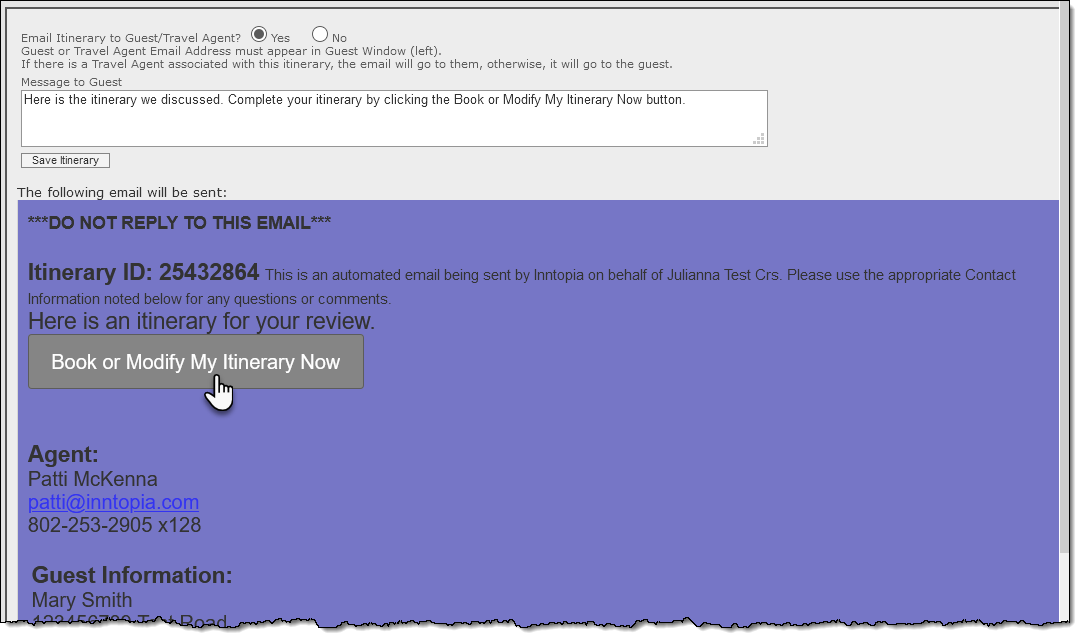

- Agent saves and emails the itinerary, which contains a link to complete the reservation, to the guest.

- Guest clicks link in the email to complete the reservation and is redirected to their itinerary within the eComm checkout screens.

- Guest clicks the Complete with Affirm button and is redirected to the Affirm website to begin the loan qualification process and select a payment plan.

- Once qualification is confirmed, Affirm settles the purchase with the partner, the reservation is completed, and guest is returned to the Inntopia confirmation page.

- Partner receives payment from Affirm within one to three days.

- Modification made to itineraries paid with Affirm that result in an increase in price:

- Guest pays through traditional methods such as a credit card. The original loan timeline is not affected nor can the increase in price be added to it.

- Guest cancels and rebooks a new itinerary with a new Affirm loan.

- Guest can report a cancellation in their Affirm account but must also contact the merchant from whom they made their purchase to cancel their reservation.

- If Affirm issues a store credit rather than a return, the guest is still responsible for paying the Affirm loan.

- Agents must process refunds through the Affirm Merchant screens and manually record the refund in Inntopia CRS.

- Guests who made their purchase online must contact the agent/call center to request a cancellation/refund.

- Affirm mirrors and adopts cancellation and refund policies of the Inntopia partner account.

- A refund posts to a customer’s Affirm account once the partner initiates the refund and Affirm processes the refund.

- If the guest already made loan payments or a down payment, Affirm issues a refund credit to the bank account or debit card that was used to make the payments.

- Affirm does not refund any interest paid.

- Partner: Work with an Affirm representative to establish an Affirm merchant account and get the information necessary (API keys) for submission to Inntopia for activation.

- Partner: Contact Inntopia Partner Services to request Affirm activation. .

- Partner: Work with an Inntopia representative to submit the following information to Inntopia:

- Sales ID – Submit the ID of each sales channel for which you want to enable Affirm.

- Affirm Public API Key – Identifies your account with Affirm and creates tokens used to authenticate your API requests to Affirm. Public API keys can be published safely.

- Affirm Private API Key– Identifies your account with Affirm and is used to perform any API request to Affirm (with some restrictions). The private API key must be kept confidential to keep your Affirm account secure.

- Inntopia: Activate Affirm in the Stage environment for each requested sales channel.

- Inntopia: Work with the partner to perform testing.

- Inntopia + Partner: When testing is completed, coordinate a go-live date.